Ira required minimum distribution worksheet

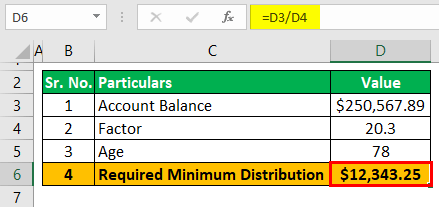

You reached age 72 on July 1 2021. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

2

The following tips can help you fill out Ira Required Minimum Distribution Worksheet quickly and easily.

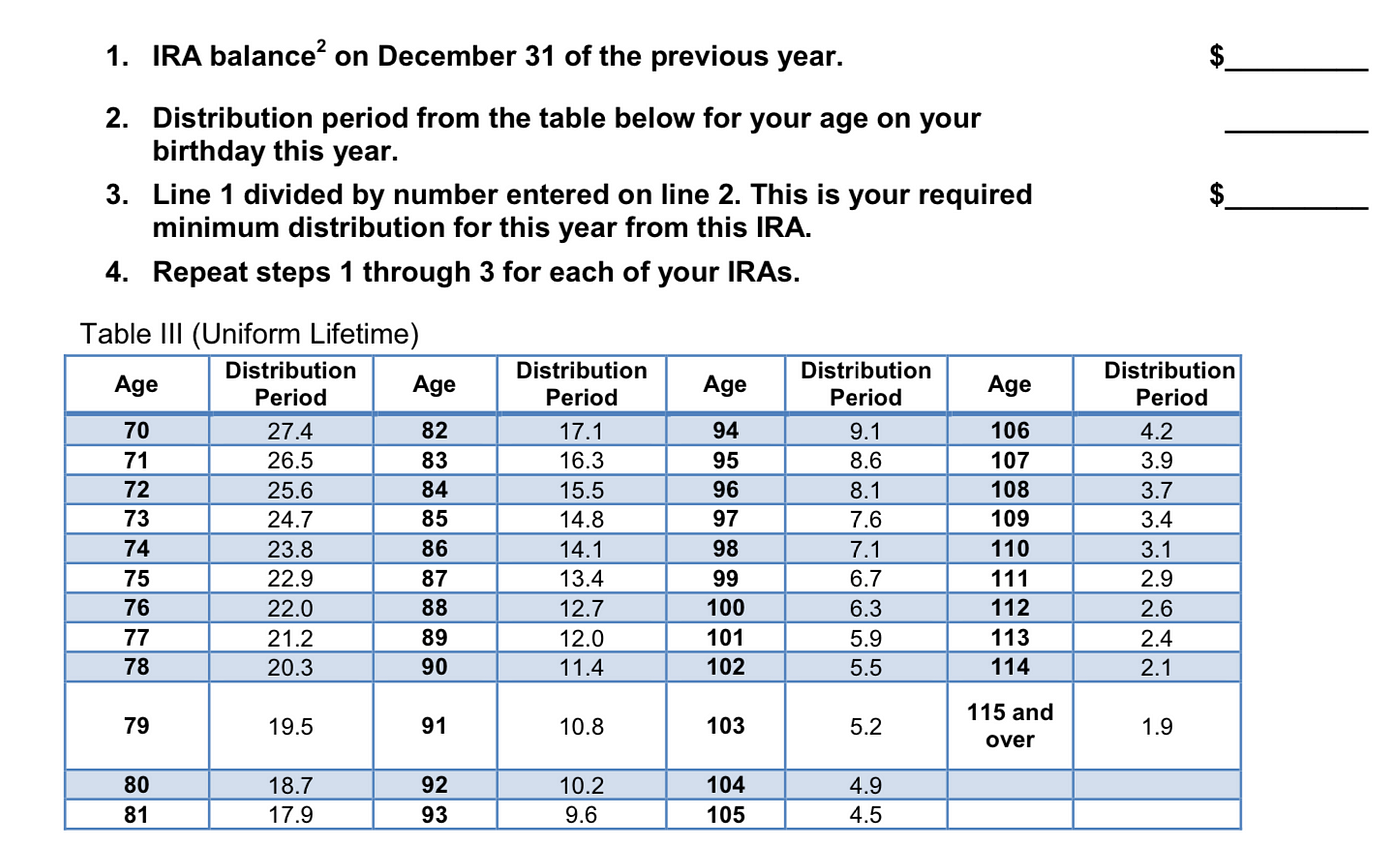

. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on. Fill in the required. Required minimum distributions RMDs are amounts that US.

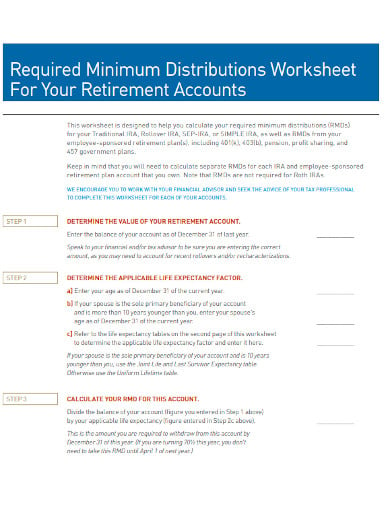

In general excluding Roth IRAs retirement plans including Self-Directed IRAs and Solo 401 k plans are. Use this worksheet to figure this years RMD for your traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you. List each tax-deferred retirement account and the balance on December 31 last year.

Type all required information in the necessary. Divide each balance by your life. Required Minimum Distribution Worksheet - use this only if your spouse is the sole beneficiary of your IRA and is more than 10 years younger than you Required Minimum.

Your RMD worksheet 2 How to calculate your RMDs Step 1. Use a irs minimum distribution template to make your document workflow more streamlined. Get form IRA Required Minimum Distribution Worksheets this worksheet to figure this years.

You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you reach 72. Open the form in the feature-rich online editor by clicking Get form. Required Minimum Distribution Rules Explained.

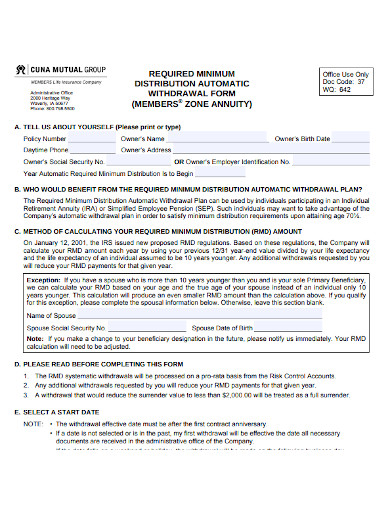

IRA Required Minimum Distribution Worksheet Use this worksheet to figure this years required withdraw for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and. Follow our easy steps to get your IRS IRA Required Minimum Distribution Worksheet ready rapidly. You might need to take a little extra time in 2022 to plan your required minimum distributions RMDs from IRAs 401 ks and other qualified retirement plans.

Choose the web sample in the library. Required Minimum Distribution Inherited IRA Worksheet DO NOT use this worksheet for a surviving spouse who elects to treat an inherited IRA as hisher own or rolls the inherited IRA. Tax law requires one to withdraw annually from traditional IRAs and employer-sponsored retirement plans.

A few of the.

2

Required Minimum Distribution Calculator Estimate Minimum Amount

Ira Required Minimum Distribution Worksheet Traditional Ira Pdf4pro

2

Rmd Table Rules Requirements By Account Type

Ira Required Minimum Distribution Worksheet Traditional Ira Pdf4pro

2

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Ira Required Minimum Distribution Worksheet Fill And Sign Printable Template Online Us Legal Forms

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Khabar Navigating Your Required Minimum Distribution

2

Rmd Table Rules Requirements By Account Type

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Required Minimum Distribution Calculator Estimate Minimum Amount

The Double Whammy Of Required Minimum Distribution In A Recession By Anthony Lawrence Pcunix Wrong Wrong Wrong Medium